The Ultimate Guide to CFD Forex Trading: Strategies, Risks, and Best Practices

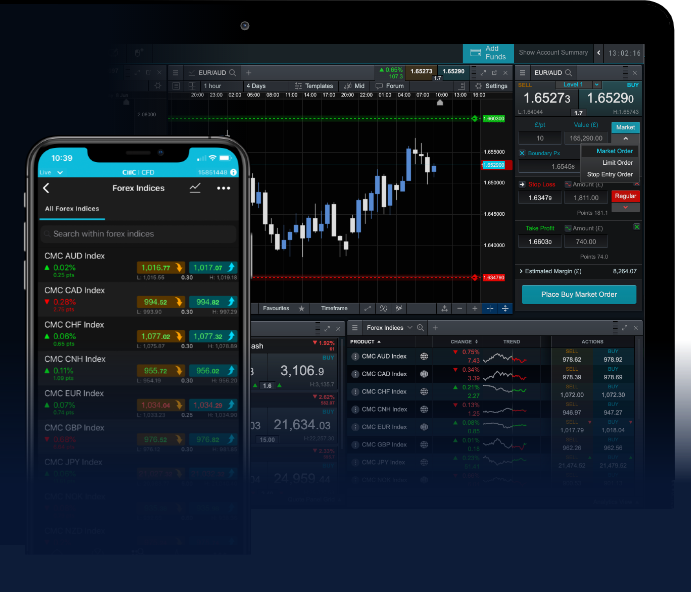

Contract for Difference (CFD) trading in the Forex market has become increasingly popular among investors looking for opportunities to profit from currency price fluctuations. This article will delve into what CFD Forex trading is, how it works, the benefits and risks associated with it, and effective strategies for success. If you’re considering entering this dynamic market, cfd forex trading Trading Broker SA can provide you with the essential tools and resources to get started.

What is CFD Forex Trading?

CFD trading allows traders to speculate on the price movements of currency pairs without actually owning the underlying assets. Instead of purchasing a currency pair directly, you enter into a contract with a broker that reflects the difference between the opening and closing prices of the asset. This means you can profit from both rising and falling markets, making CFDs a versatile trading instrument.

How Does CFD Forex Trading Work?

To engage in CFD Forex trading, follow these steps:

- Select a Broker: Choose a reputable CFD broker who offers a range of currency pairs and trading platforms.

- Open a Trading Account: Register and create a trading account. Most brokers offer demo accounts for practice.

- Fund Your Account: Deposit funds into your trading account to begin trading.

- Choose a Currency Pair: Analyze the market and decide which currency pair to trade. Popular pairs include EUR/USD, GBP/USD, and USD/JPY.

- Place a Trade: Decide whether to buy (go long) or sell (go short) the currency pair, and enter your position size.

- Monitor Your Trade: Keep an eye on the market and manage your trade accordingly, using tools like stop-loss and take-profit orders.

Benefits of CFD Forex Trading

CFD Forex trading offers several advantages for traders. Here are some key benefits:

- Leverage: CFDs allow you to trade on margin, meaning you can control a larger position with a smaller amount of capital. This can amplify your profits, though it also increases risk.

- Short Selling: With CFDs, you can profit from falling markets by selling currency pairs short.

- Diverse Markets: CFD forex trading allows you to access a wide range of currency pairs, including major, minor, and exotic pairs.

- No Ownership of Underlying Asset: Since you don’t own the actual currency, you are not exposed to certain costs associated with owning physical assets, such as storage or transfer fees.

- 24/5 Market Hours: The forex market operates 24 hours a day during weekdays, allowing you to trade at your convenience.

Risks of CFD Forex Trading

While CFD Forex trading presents lucrative opportunities, it also comes with significant risks. Here are some factors to consider:

- Leverage Risks: High leverage can magnify both gains and losses, making it crucial to manage your positions carefully.

- Market Volatility: The forex market can be highly volatile, resulting in rapid price changes that can lead to significant losses even within a short time frame.

- Counterparty Risks: Trading CFDs relies on your broker fulfilling contracts. If a broker becomes insolvent or defaults, you may lose your investment.

- Emotional Trading: The fast-paced nature of forex trading can lead to impulsive decisions driven by emotions rather than sound strategies.

Effective Strategies for CFD Forex Trading

To succeed in CFD Forex trading, consider implementing the following strategies:

- Technical Analysis: Use charts, indicators, and patterns to identify potential price movements. This analysis can help you determine optimal entry and exit points.

- Fundamental Analysis: Stay informed about economic indicators, geopolitical events, and central bank policies, as these factors can significantly influence currency prices.

- Risk Management: Set a stop-loss order to limit potential losses, and never risk more than you can afford to lose. Consider diversifying your trades to spread risk across different currency pairs.

- Practice with a Demo Account: Use a demo trading account to hone your skills and test different strategies without risking real money.

- Stay Disciplined: Stick to your trading plan and avoid making impulsive decisions based on emotions or market noise.

Conclusion

CFD Forex trading provides an exciting way for traders to engage with the forex market and capitalize on currency price fluctuations. Understanding how CFDs work, their benefits and risks, and employing sound trading strategies can enhance your chances of success. Remember to choose a reliable broker, conduct thorough research, and manage your risk effectively. With these principles in mind, you can navigate the CFD Forex market with confidence and potentially achieve your trading goals.